Last Updated on 2025-10-02

Economists, psychologists, and entrepreneurs have explored the intricate connection between income, happiness, and life satisfaction for decades. Does money make us happy? There’s evidence it can, but also a complicated connection between money, happiness, and contentedness. The complex relationship between income happiness and life satisfaction has fascinated economists, psychologists and entrepreneurs for decades. Money is a factor in these areas, for sure, but its impact varies by personal circumstance, aspirations and larger economic factors, like inflation. So let’s check out the recent research.

Key Insights: How Much Money is Enough?

Happiness Peaks

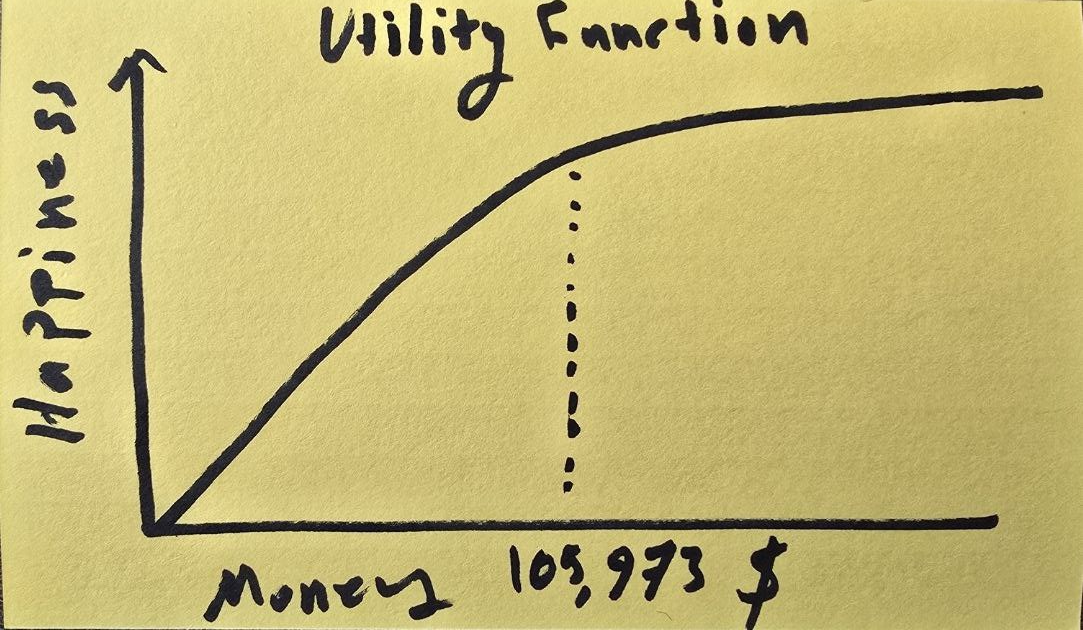

The enduring image of happiness was provided by Kahneman and Deaton (2010), whose path breaking study of the relationship between income and happiness found a plateau in happiness at $75,000 dollars per year in the United States: Beyond this level, income beyond this has little additional effect on emotional well-being on a daily basis, including joy, pleasures, and reduced stress. Inflation-adjusted, this threshold increases to $105,973 in 2024.

But why does the plateau of happiness happen? Once basic needs — housing, food, health care — are satisfied, added income doesn’t do much to change everyday emotions. Rather, it is everything from great relationships to direction and free time that are more important.

Satisfaction Keeps Growing

Life satisfaction, however, paints a different picture. As a general assessment of one’s situation — of success, accomplishments, and life’s ambitions — satisfaction rises with income, even at higher levels.

This compares to the happiness threshold in 2010, which hovered between $120,000.

By 2024, inflation adjusted, that range is between $169,557 and $287,554 for people living in high-cost areas.

Satisfaction displays a more linear relationship with income because money affords access to opportunities, control over the environment, and a degree of freedom to pursue long-term ambitions — none of which applies to the more ephemeral feeling of happiness.

Why Money Impacts Happiness and Satisfaction Differently

Happiness is About the Present

Happiness connects to immediate needs and day-to-day experiences. Once basic needs are satisfied, money’s power to produce positive feelings wears off — a “diminishing returns” effect. Out of those, key drivers of happiness outside of money are:

- Meaningful relationships

- Time for leisure

- A sense of purpose

Satisfaction Reflects Long-Term Goals

It has been argued that satisfaction is connected to greater ideals, like the attainment of a personal or professional aspiration. “Higher-income allows for:

- Education

- tourism

- access to investments

Backing of long-term aspirations More control of your life situations So satisfaction is more elastic to income levels, especially for high achievers or those more conscious of their peers.”

Know more: What is Financial freedom?

What Does This Mean for Entrepreneurs?

Many entrepreneurs have a unique relationship with money and with happiness/satisfaction in their work.

- Happiness: Revenues between $500,000 and $2 million annually often provide financial security, reduce stress, and enable a healthier work-life balance.

- Satisfaction: Building a scalable business and achieving financial freedom typically requires revenues between $2 million and $10 million annually.

Why Money Matters (But Isn’t Everything)

Money provides comfort, reduces stress, and opens doors to opportunities, but it’s only part of the equation. To truly maximize happiness and satisfaction, other factors are essential:

- Strong relationships: Both personal and professional bonds bring emotional fulfillment.

- Health and well-being: Physical and mental health play a major role in happiness.

- Purpose and meaning : Doing meaningful, impactful work creates long-term satisfaction.

Key Takeaway: Balance is Everything

Money can improve both happiness and satisfaction, but their dynamics differ. Happiness has a ceiling, with its benefits leveling around $105,973 annually. Satisfaction, however, continues to rise with income—albeit at a slower pace—because of its connection to long-term goals. To thrive, focus on building relationships, maintaining health, finding purpose, and achieving financial success.

Final Thoughts

In 2024, inflation and increasing living costs will push the happiness and satisfaction income thresholds higher than they’ve ever been in previous decades. Money is undoubtedly one of the big keys to a less stressful life so you can focus on your goals but true transformation is a 360 body mission not just finances. Entrepreneurs especially need to think about revenue targets and about the wider impact of what they do on their lives and communities.

P.S.

It’s important to note that this research primarily reflects the context of the United States, where individualistic cultural values and financial systems significantly influence these findings. In the U.S., many essentials and luxuries can be purchased through installment plans, making financial flexibility more accessible. This cultural and economic framework may not directly apply to countries with collectivist cultures or different financial systems, where family support or limited access to credit might play a larger role in financial security and satisfaction.